March 09, 2011

The Cook County Board recently passed the County’s FY2011 budget. The budget included large reductions to most County agencies and reflects difficult choices made by the County leadership. The budget also began implementation of some of the recommendations from the Cook County Modernization Report. However, the FY2011 budget is just the start of the heavy lifting that will be necessary to address the fiscal and operational challenges confronting the County. The FY2011 budget will be a particularly challenging budget to implement and the County faces continuing budget shortfalls in the coming years.

As identified in the Civic Federation’s analysis and recommendations on the proposed FY2011 Cook County budget, the County will likely have budgetary shortfalls in coming years due to the following:

-

Cost drivers: The County has significant costs that continue to increase unabated. One of the major cost drivers is fixed charges, which are shared costs borne by the County as a whole. The majority of these expenses relate to personnel, such as health insurance and workers’ compensation.

-

Repeal of the remaining portion of the sales tax: The Civic Federation believes that as Chicago’s sales tax rate is one of the highest composite rates in the nation, the County’s sales tax increase must be fully repealed. However, repeal will have a large budgetary impact that will require further expenditure reductions or alternative revenue sources. On February 25, the Board passed an amendment to repeal the remainder of the 1.0% sales tax increase by 2013.

-

Non-recurring revenues: Some of the County’s deficit closing measures are not permanent. For example, the $85.0 million the County expects to generate from proposed bond restructuring is only expected to generate revenue for the next three years and will result in higher future debt service payments.

-

Pension funds: The County has a declining pension fund ratio that will require either increased funding and/or an adjustment in non-vested benefits. This will put additional pressure on the rest of the budget as the pension fund requires increased resources.

In addition, the final adopted budget replaced 550 full-time equivalent (FTE) position reductions with furlough days, which only provides a temporary budget solution.

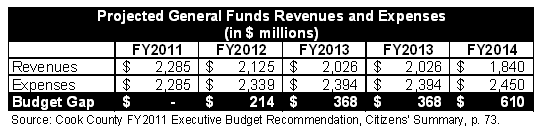

Cook County’s budget projections illustrate its fiscal challenges. County projections of revenues and expenses indicate that in FY2012 it will face a $214 million budget gap. This shortfall is much smaller than in FY2011 because the County has begun to make structural changes, but is still a very sizable gap. By FY2014 the budget shortfall is projected to reach $610 million.

Another challenge will be making the expenditure reductions and revenue targets adopted in the FY2011 budget. In prior years, adopted FTE reductions and budgeted increases in fee revenue have not always materialized. The implementation of a large number of layoffs and furlough days in the FY2011 budget will present management with a challenge. The budget also includes $32 million in savings from strategic initiatives, which anticipates savings from a procurement overhaul, a desk audit and span of control changes.[1] Lastly, the Health System’s FY2011 budget shows a 27.3% increase in patient fee revenues, from a FY2010 preliminary figure of $252.4 million to $321.2 million in FY2011. Included in fee revenues are a 33.5% increase in fees from Medicaid and a 74.2% increase from private insurers. These projections appear to be optimistic, particularly in light of the fact that Medicaid fees in FY2010 were 22.0% below budget.[2]

The County will need to have a sustained focus on the budget in the coming year through continued commitment to operational reforms and structural changes as well as long-range financial planning that addresses the County’s cost drivers, tax structure and that prioritizes services. Continued reforms will be needed over the next four years to address the coming budget shortfalls. The Civic Federation’s Cook County Modernization Report contains a variety of recommendations that can assist the County in continuing the reform process.